Debt recycling is a financial strategy that can help individuals maximize their gains and achieve long-term wealth. By understanding the basics of debt recycling and its financial benefits, individuals can make informed decisions about their own financial future.

Understanding the Concept of Debt Recycling

Debt recycling is a powerful financial strategy that allows individuals to leverage the equity in their homes to invest in income-generating assets. By doing so, they can use their existing debt to build wealth and create a more secure financial future.

The Basics of Debt Recycling

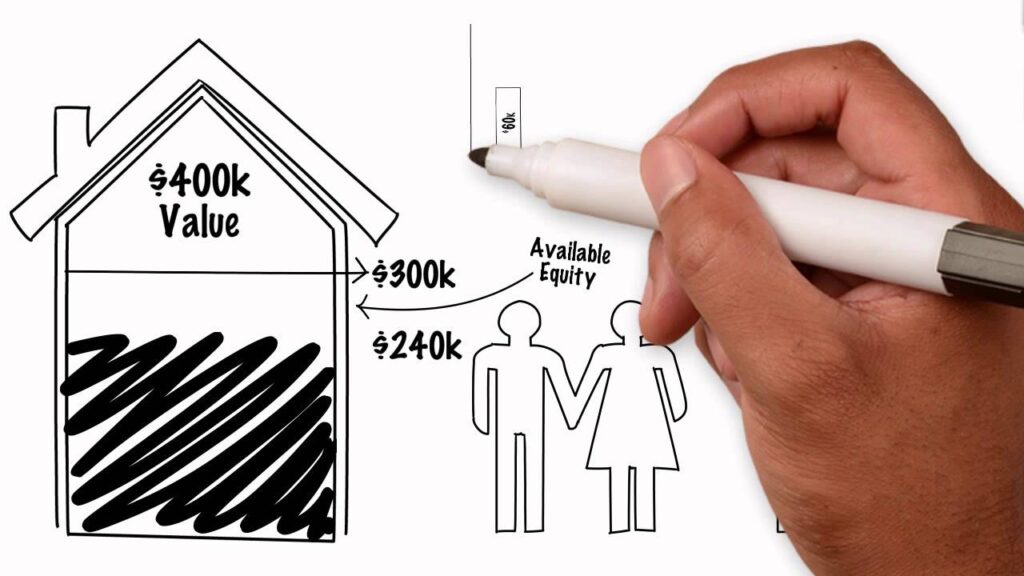

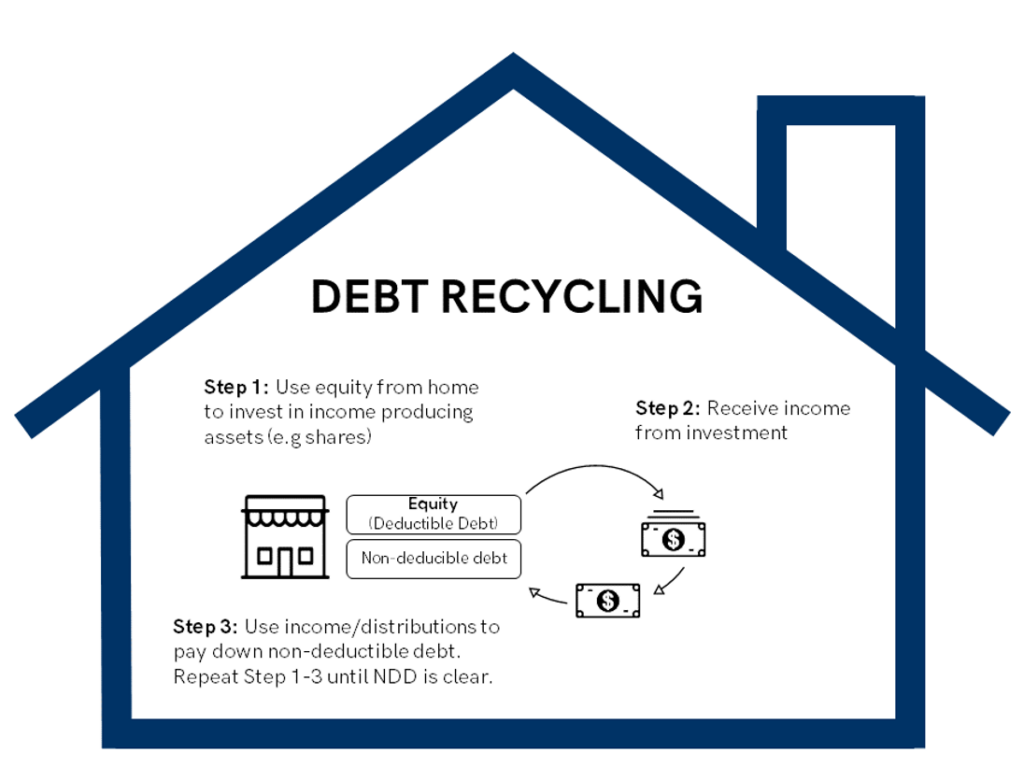

At its core, debt recycling strategy involves refinancing an existing mortgage to access the equity that has been built up in a home. This equity can then be used to invest in various assets, such as stocks, bonds, or other income-generating investments.

By refinancing, individuals can tap into the value of their home and unlock a new source of funds. These funds can then be strategically invested in assets that have the potential to generate a steady stream of income over time.

Once the investments start generating income, this money can be used to pay down the mortgage more quickly. By doing so, individuals can further increase the equity in their homes and create a positive cycle of debt reduction and wealth creation.

Related: Crafting a Tax Plan Tailored to You

The Financial Benefits of Debt Recycling

One of the key financial benefits of debt recycling is the potential for tax deductions. When individuals use the funds from their refinanced mortgage to invest in income-generating assets, they may be able to deduct the interest paid on the borrowed funds from their taxable income.

This tax deduction can significantly reduce the overall tax burden and increase the return on investment. It provides individuals with an opportunity to optimize their tax strategy and maximize the benefits of debt recycling.

Furthermore, by using the income generated from investments to pay down the mortgage, individuals can accelerate the process of building equity in their homes. This increased equity can serve as a financial safety net and provide individuals with a sense of security.

Moreover, the additional equity can unlock opportunities for further investment. With a larger equity base, individuals may have access to better loan terms and conditions, allowing them to invest in even more income-generating assets and grow their wealth at an accelerated pace.

In conclusion, debt recycling is a powerful financial strategy that allows individuals to use their existing debt to build wealth. By refinancing their mortgage and investing the funds in income-generating assets, individuals can benefit from potential tax deductions and accelerate the process of building equity in their homes. This strategy provides individuals with a pathway to create a more secure financial future and unlock opportunities for further investment.

The Mechanics of Debt Recycling

Debt recycling is a financial strategy that utilizes the concept of compounding interest to accelerate the repayment of your mortgage and create wealth. By borrowing funds and investing them, you have the potential to earn higher returns on your investments compared to the interest rate on your mortgage. This difference in returns can then be used to pay off your mortgage faster.

But how does debt recycling actually work? Let’s dive into the details.

How Debt Recycling Works

When you borrow funds to invest, you are essentially leveraging your assets. By investing the borrowed funds, you have the opportunity to generate additional income and grow your wealth. The returns from your investments can then be used to make extra repayments on your mortgage, reducing the principal amount and the interest charged over time.

As you continue to repay your mortgage, the equity in your home increases. This increased equity can then be accessed to fund further investments, continuing the cycle of debt recycling and wealth creation.

Imagine this scenario: You have a mortgage with an interest rate of 4% and you borrow an additional amount at an interest rate of 3% to invest in a diversified portfolio. If your investments generate a return of 7%, you would be earning a 4% net return after deducting the interest on the borrowed funds. This 4% net return can then be used to make extra repayments on your mortgage, effectively reducing the interest charged and the time it takes to pay off your loan.

However, it’s important to note that debt recycling involves risks. The performance of your investments can fluctuate, and there is always the possibility of losses. It’s crucial to carefully evaluate potential investment opportunities and ensure they align with your risk tolerance and financial goals.

Key Components of a Successful Debt Recycling Strategy

Successfully implementing a debt recycling strategy requires careful planning and consideration. Here are some key components to keep in mind:

Evaluating your investment options

It is essential to carefully evaluate potential investment opportunities and select those that align with your risk tolerance and financial goals. Diversification is also crucial to minimize risk and maximize returns.

Monitoring and adjusting your strategy

Regularly reviewing and adjusting your debt recycling strategy can ensure that it continues to align with your evolving financial situation and goals. Keep track of your investments’ performance and make necessary changes to optimize your returns.

Seeking expert guidance: Engaging the services of a knowledgeable financial advisor can provide valuable insights and support in maximizing the effectiveness of your debt recycling strategy. They can help you navigate the complexities of investing and ensure you make informed decisions.

Remember, debt recycling is not suitable for everyone. It requires discipline, careful planning, and a long-term perspective. It’s important to assess your financial situation and goals before deciding to embark on a debt recycling strategy.

By understanding the mechanics of debt recycling and implementing it wisely, you can potentially accelerate your mortgage repayment and build wealth over time.

Risks and Challenges in Debt Recycling

Debt recycling, a strategy that involves using borrowed funds to invest and generate wealth, can offer significant financial benefits. However, it is important to be aware of potential risks and challenges that may arise along the way. By understanding these risks and developing strategies to overcome them, you can navigate the debt recycling journey with confidence.

Identifying Potential Risks

Before embarking on a debt recycling strategy, it is crucial to identify and assess potential risks that may impact its effectiveness. By doing so, you can proactively address these risks and minimize their impact. Some risks to consider include:

Market volatility:

Investments can be subject to fluctuations in value, influenced by various factors such as economic conditions, geopolitical events, and industry trends. These fluctuations can impact the overall effectiveness of your debt recycling strategy. It is important to stay informed about market trends and make informed investment decisions.

Interest rate changes:

Changes in interest rates can have a significant impact on the affordability of your mortgage and the returns generated from your investments. Rising interest rates can increase the cost of borrowing, potentially affecting your ability to service your debt. It is essential to monitor interest rate movements and consider their potential impact on your debt recycling strategy.

Financial discipline:

Debt recycling requires a high level of financial discipline. It is crucial to ensure that borrowed funds are used for productive investments rather than frivolous spending. Maintaining a strong sense of financial discipline can help you stay on track and maximize the benefits of debt recycling.

Overcoming Common Challenges

While risks are inherent in any investment strategy, there are strategies to help overcome the challenges associated with debt recycling. By implementing these strategies, you can increase the likelihood of success and mitigate potential setbacks. Some strategies to consider include:

Regularly review your investments:

Keeping a close eye on your investments is crucial to the success of your debt recycling strategy. Regularly reviewing your portfolio allows you to assess its performance, identify any underperforming assets, and make necessary adjustments. By staying proactive, you can capitalize on new investment opportunities and optimize your returns.

Build an emergency fund:

Having an emergency fund is essential in any financial strategy. It provides a buffer in case of unexpected financial challenges, such as job loss or medical emergencies. By setting aside a portion of your income for emergencies, you can protect your investments and ensure the stability of your debt recycling strategy.

Stay committed to financial discipline:

Financial discipline is the cornerstone of a successful debt recycling strategy. It involves making conscious decisions about your spending habits, prioritizing debt reduction, and adhering to a budget. By staying committed to financial discipline, you can effectively manage your debt, maximize your investment returns, and achieve your long-term financial goals.

By understanding the risks and challenges associated with debt recycling and implementing strategies to overcome them, you can navigate this financial strategy with confidence. Remember, successful debt recycling requires careful planning, ongoing monitoring, and a commitment to financial discipline. With the right approach, you can unlock the potential benefits and achieve your financial objectives.

Maximizing Gains through Debt Recycling

Strategies for Maximizing Your Wealth

To maximize your gains through debt recycling, consider implementing the following strategies:

- Diversify your investments: Spreading your investments across different asset classes can help mitigate risk and potentially enhance returns.

- Regularly review and adjust your strategy: Stay up-to-date with market trends and adapt your debt recycling strategy accordingly.

- Take advantage of tax benefits: Explore all available tax deductions and credits to optimize the financial benefits of your debt recycling strategy.

The Role of Financial Discipline in Wealth Maximization

Financial discipline is a critical factor in maximizing the gains through debt recycling. It requires a commitment to staying focused on your long-term financial goals and resisting the temptation to divert funds away from your investment strategy.

By maintaining financial discipline, you can ensure that your debt recycling strategy remains on track and continues to generate positive results over the long term.

The Role of Expert Guidance in Debt Recycling

Why Expert Guidance is Crucial

Given the complexities involved in debt recycling, seeking expert guidance is crucial for achieving optimal results. A knowledgeable financial advisor can provide guidance on evaluating investment options, structuring your debt recycling strategy, and staying on top of changing market conditions.

Furthermore, an experienced financial advisor can provide valuable insights into tax planning and strategies to mitigate risks associated with debt recycling.

Finding the Right Financial Advisor for Debt Recycling

When searching for a financial advisor for debt recycling, it is important to find someone who specializes in this area and has a track record of success. Take the time to research and interview potential advisors to ensure they have the expertise and qualifications necessary to guide you on your journey towards wealth maximization.

Remember, the right financial advisor can make a significant difference in the success of your debt recycling strategy.

Conclusion

Debt recycling presents a powerful opportunity to leverage existing debt and create wealth over the long term. By understanding the basics, mechanics, and potential risks involved, individuals can take steps towards maximizing their gains through this strategy. With financial discipline and the guidance of an expert, individuals can embark on a journey towards financial freedom and wealth accumulation. So, start revolving towards wealth through expert debt recycling and unlock a brighter financial future.