In today’s rapidly changing financial landscape, it is crucial to stay ahead of the curve and embrace innovative strategies that can shape your financial destiny. One such strategy that has gained popularity in recent years is debt recycling. Understanding the concept of debt recycling and its implications is key to unlocking its potential benefits for your financial health. In this article, we will delve into the basics of debt recycling, explore its role in financial management, discuss its financial impact, and outline practical steps to implement this strategy. Additionally, we will examine the role of technology in debt recycling and how it is revolutionizing the way we manage our debts.

Understanding the Concept of Debt Recycling

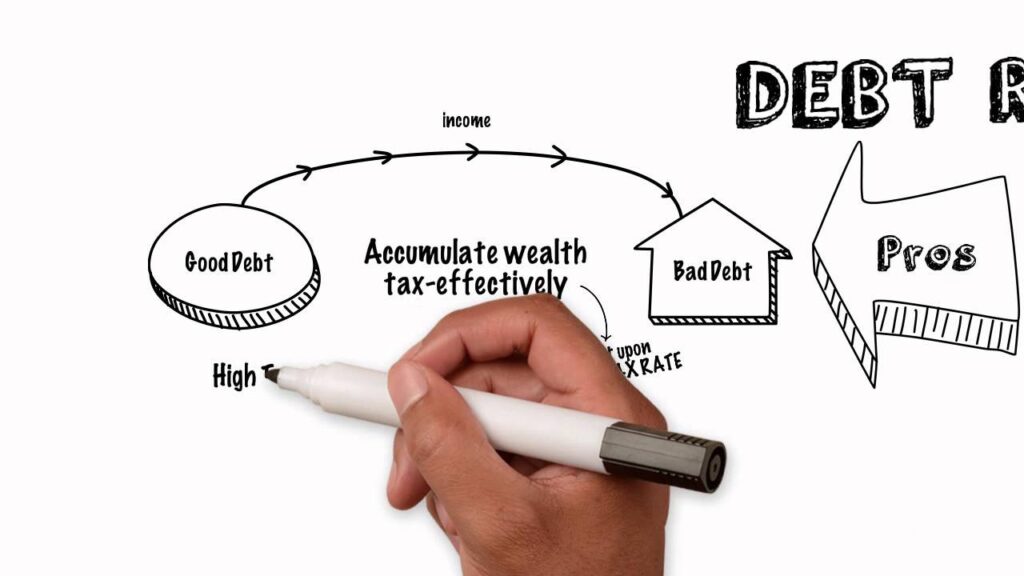

Debt recycling is a financial strategy that involves leveraging the equity in your existing investments, such as property or shares, to pay off non-deductible debt, such as personal loans or credit card debt. By utilizing expert strategy of financial wellness coach services by financial advisor Sydney, you can potentially reduce your overall debt burden and increase your tax deductions, ultimately improving your financial position.

When considering debt recycling, it’s essential to assess the risk involved. While this strategy can offer significant benefits, including tax advantages and debt reduction, it also carries risks associated with leveraging investments and potential fluctuations in asset values. It’s crucial to have a solid understanding of your financial situation and risk tolerance before embarking on a debt recycling plan. Learn more about SMSF taxation strategies for optimal returns.

The Basics of Debt Recycling

At its core, debt recycling involves borrowing against your existing investments and using the funds obtained to pay off high-interest non-deductible debt. By doing so, you effectively convert your non-deductible debt into deductible debt, which can help minimize your tax liability. This strategy is particularly beneficial for individuals who have substantial equity in their investments and high non-deductible debt levels.

Moreover, debt recycling can provide a valuable opportunity to review and potentially optimize your investment portfolio. By reassessing your assets and liabilities, you can identify underperforming investments or high-cost debts that may be hindering your financial growth. This process of financial review and reallocation can lead to a more efficient and effective wealth management strategy.

The Role of Debt Recycling in Financial Management

Debt recycling plays a crucial role in overall financial management as it allows you to optimize your debt structure and increase your tax benefits. By strategically allocating your debts and assets, you can enhance your cash flow, reduce your interest expenses, and maximize your tax deductions. Moreover, debt recycling offers a pathway to accelerate the growth of your investments and increase your net worth over time.

It’s important to note that debt recycling is a long-term strategy that requires careful planning and monitoring. Regularly reviewing your investment performance, debt levels, and tax implications is essential to ensure that your financial goals are being met and that you are effectively managing any associated risks. By staying informed and proactive in your financial decisions, you can leverage debt recycling to build wealth and secure your financial future.

The Financial Impact of Debt Recycling

Implementing debt recycling can have a significant positive impact on your financial health. By utilizing the equity in your existing investments, you can effectively reduce your non-deductible debt and replace it with deductible debt. This not only lowers your overall interest payments but also increases your ability to claim tax deductions, resulting in potential savings. By redirecting these savings towards your investments, you can accelerate their growth and build wealth more effectively.

How Debt Recycling Can Improve Your Financial Health

Debt recycling can improve your financial health in multiple ways. Firstly, by replacing high-interest non-deductible debt with deductible debt, you can lower your interest expenses and potentially save thousands of dollars over time. This means that you’ll have more money available to invest in other areas of your life, such as education, travel, or even starting your own business.

Secondly, this strategy allows you to leverage your existing investments to generate tax savings, ultimately boosting your net income. By taking advantage of tax deductions, you can free up more money to allocate towards your financial goals. This could mean increasing your retirement savings, making extra mortgage payments, or even investing in additional income-generating assets.

Finally, by utilizing debt recycling, you can strategically manage your debts and assets to optimize your cash flow and improve your overall financial position. This involves carefully analyzing your current financial situation and identifying opportunities to restructure your debts in a way that aligns with your long-term goals. For example, you might choose to consolidate multiple high-interest loans into a single, lower-interest loan, reducing your monthly payments and freeing up more cash for other purposes.

Potential Risks and Downsides of Debt Recycling

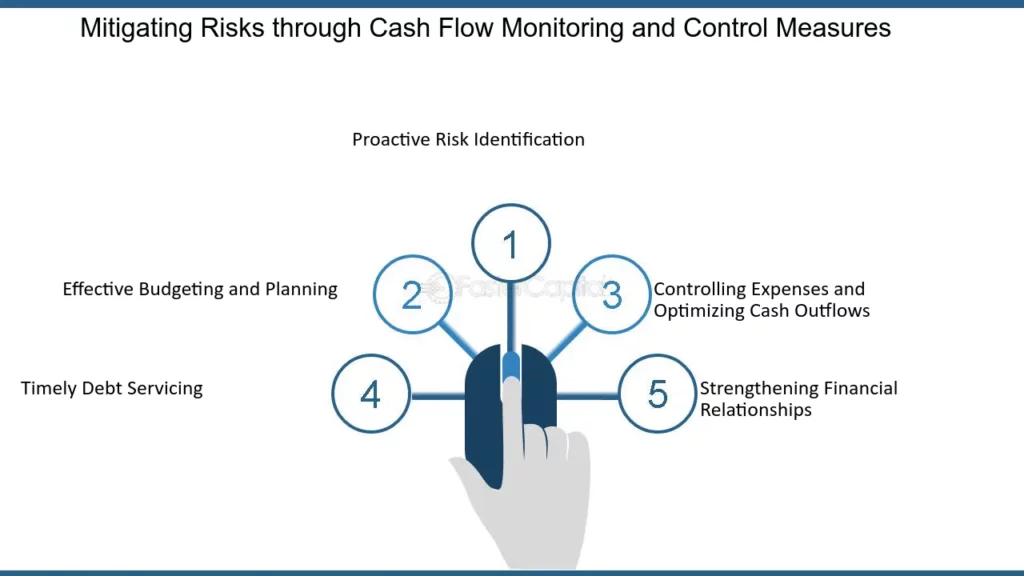

Although debt recycling offers numerous benefits, it is important to be aware of potential risks and downsides. One key consideration is the impact of market fluctuations on your investments. While debt recycling relies on the value of your investments, it’s important to remember that investments can go up and down in value. If the value of your investments declines significantly, it may affect your ability to borrow against them, potentially limiting your debt recycling options. Therefore, it’s crucial to regularly monitor and reassess your investment portfolio to ensure it remains aligned with your financial objectives.

Additionally, it is crucial to carefully manage your cash flow and ensure you can comfortably meet your debt repayment obligations. While debt recycling can be a powerful strategy, it requires discipline and responsible financial management. Failing to do so could result in financial strain and adversely impact your credit rating. It’s important to create a realistic budget, track your expenses, and prioritize debt repayment to avoid falling into a cycle of increasing debt.

By understanding the potential risks and downsides of debt recycling, you can make informed decisions and mitigate any potential negative impacts. With careful planning and diligent execution, debt recycling can be a valuable tool to enhance your financial well-being and achieve your long-term goals.

The Future of Finance and Debt Recycling

Looking ahead, debt recycling is poised to play a significant role in the future of finance. As individuals become more conscious of their financial well-being and seek ways to optimize their resources, debt recycling is likely to gain further traction. Let’s explore some predicted trends in debt recycling and how this strategy can shape your financial destiny.

As we delve deeper into the realm of finance and debt management, it becomes evident that the concept of debt recycling is not only a trend but a fundamental strategy for individuals looking to secure their financial future. The intricate interplay between debts and assets is a key aspect that debt recycling addresses, allowing individuals to leverage their financial resources effectively.

Predicted Trends in Debt Recycling

Experts foresee an increase in demand for debt recycling services, driven by the growing awareness of its potential benefits. As more individuals recognize the value of optimizing their debts and assets, the financial industry is expected to offer more specialized products and tailored solutions to cater to this demand. Additionally, advancements in technology are revolutionizing debt recycling, making it more accessible and efficient for individuals of all financial backgrounds.

Furthermore, the evolution of debt recycling is likely to encompass a more holistic approach, integrating not just financial considerations but also environmental and social impacts. The future of debt recycling may see a shift towards sustainable finance practices, where individuals can align their debt management strategies with their values and contribute to a more sustainable economy.

How Debt Recycling Can Shape Your Financial Destiny

Debt recycling has the power to shape your financial destiny by offering a structured pathway to enhance your financial well-being. By implementing this strategy, you can optimize your debt structure, minimize your tax liability, and accelerate the growth of your investments. Moreover, debt recycling empowers you to take control of your finances, make informed decisions, and build a strong foundation for long-term wealth creation.

When considering the impact of debt recycling on your financial destiny, it is essential to recognize the ripple effects it can have on your overall financial health. By strategically managing your debts and assets through recycling, you not only secure your present financial stability but also pave the way for a prosperous future filled with opportunities for growth and financial freedom.

Practical Steps to Implement Debt Recycling

Embarking on a debt recycling journey requires careful planning and execution. Here are some practical steps to help you get started:

Debt recycling is a financial strategy that involves leveraging your existing assets to invest in income-producing assets, thereby converting non-tax-deductible debt into tax-deductible debt. By implementing debt recycling, individuals can potentially accelerate wealth creation and reduce their overall tax liability over time.

Getting Started with Debt Recycling

1. Evaluate your existing debt: Assess your current non-deductible debt and identify opportunities where debt recycling can be beneficial. Look for assets with equity that can be used as collateral for tax-deductible investment loans.

2. Review your investments: Analyze the equity in your investments to determine their potential for borrowing and debt recycling. Consider the potential returns and risks associated with each investment to make informed decisions.

3. Seek professional advice: Consult with a financial advisor who specializes in debt recycling to understand the specific opportunities and risks associated with your financial situation. A qualified advisor can help you create a customized debt recycling strategy tailored to your goals and risk tolerance.

Expanding your knowledge on debt recycling can also involve attending workshops or seminars conducted by financial experts in the field. These events can provide valuable insights and real-life case studies to deepen your understanding of the strategy.

Maintaining and Optimizing Your Debt Recycling Strategy

1. Regularly review your debt structure: Periodically assess your debt portfolio to ensure it aligns with your financial goals and objectives. Consider refinancing options or adjusting your investment mix to optimize your debt recycling strategy.

2. Monitor the performance of your investments: Stay updated on the market conditions and the performance of your investments to anticipate potential fluctuations or opportunities. Keep a close eye on interest rates and investment returns to make timely adjustments to your debt recycling plan.

3. Seek ongoing support: Continuously engage with your financial advisor to receive guidance on optimizing your debt recycling strategy and making informed decisions. Regular discussions with your advisor can help you stay on track with your financial goals and adapt to changing market conditions.

The Role of Technology in Debt Recycling

Technology has emerged as a game-changer in various aspects of finance, and debt recycling is no exception. Fintech, or financial technology, is transforming the way we manage our debts and interact with financial institutions. Let’s explore how technology is revolutionizing debt recycling.

How Fintech is Revolutionizing Debt Recycling

With the advent of digital platforms and innovative financial tools, debt recycling has become more accessible and streamlined. Online platforms now offer comprehensive debt recycling calculators, enabling individuals to quickly assess the potential benefits and outcomes of implementing this strategy. Moreover, automation and artificial intelligence-based systems are simplifying the application and approval process, making debt recycling more efficient and convenient for borrowers.

The Impact of Digital Platforms on Debt Management

Digital platforms have revolutionized the way we manage our debts by providing real-time access to financial information and alternative solutions. Through these platforms, individuals can monitor their debts, track their progress, and make informed decisions about debt recycling. Additionally, digital platforms facilitate seamless communication between borrowers and financial institutions, streamlining the entire debt management process.

As the finance industry continues to evolve, debt recycling stands out as a powerful strategy that can reshape your financial destiny. By understanding the basics of debt recycling, recognizing its financial impact, and leveraging technology to optimize this strategy, you can unlock the potential benefits and navigate the future of finance with confidence.